FORT MILL, S.C. — At its regular meeting on April 15, the Fort Mill School District Board reviewed a proposed 2025–2026 General Fund Budget that includes a significant local tax increase to support operational needs. The plan recommends a 21.2 mill increase in the local property tax rate — on top of a previous tax hike tied to recently approved bond measures. This refers to the district’s General Fund Budget, which covers day-to-day operational expenses. Under Act 388, the General Fund is approved by the Board of Trustees and a portion of the budget is funded through taxes on local businesses, rental properties, vehicles, boats, and non-primary residences. It does not include taxes on owner-occupied homes.

Assistant Superintendent for Finance and Operations Leanne Lordo presented the budget proposal, which totals $253 million. The increase in millage is aimed at addressing rising personnel costs, inflation, and state-mandated salary adjustments. According to Lordo, the proposed budget continues to prioritize teacher recruitment, staff retention, and manageable class sizes, while maintaining compliance with state regulations.

The initial proposed budget for the 2025–2026 school year includes a 21.2 mill increase to support the district’s operational needs. This was the first discussion of the 2025–2026 budget, and the budget process will continue over the next several board meetings.

Under the current proposal, 89.6% of the budget is allocated for salaries and benefits. The district projects a $13.3 million increase in local tax revenue, factoring in the full 21.2 mill increase — the maximum allowed based on a combined 7.4% growth in the Consumer Price Index and local population. With one mill valued at $360,000, the tax adjustment would account for a substantial portion of the district’s revenue increase.

State funding is projected to rise by just $4.6 million, covering less than half of the district’s required teacher pay increases. This disparity has prompted local leaders to lean more heavily on property taxes to close the gap. The district intends to raise the starting teacher salary from $50,000 to $52,500, outpacing the state’s minimum requirement of $48,500. A 5% raise is proposed for teachers, with a 4% cost-of-living adjustment planned for other staff.

The district continues to express concern over the state’s education funding formula, which it says does not adequately reflect the needs of fast-growing districts like Fort Mill. The current state aid to classrooms model is set to provide only 38.1% of the district’s total revenue for next year.

Enrollment projections for the 2025–26 school year estimate 18,618 students, an increase from the current Average Daily Membership of 18,188. The budget also includes a $2.8 million contingency reserve to support the opening of Flint Hill Elementary School next year.

In addition to budget discussions, the board received a $57,400 donation from the Foundation for Fort Mill Schools to fund the purchase of a Starlab portable planetarium, which will support the district’s science curriculum.

Board member Lipi Pratt also provided an update on the ongoing superintendent search. Applications are due by April 28, with interviews and a final selection scheduled for May. The new superintendent is expected to begin by July.

More information about the budget proposal and superintendent search is available on the Fort Mill School District website. Recordings of board meetings are accessible via the district’s YouTube channel.

Fort Mill School Board Meeting Highlights Provided by the District

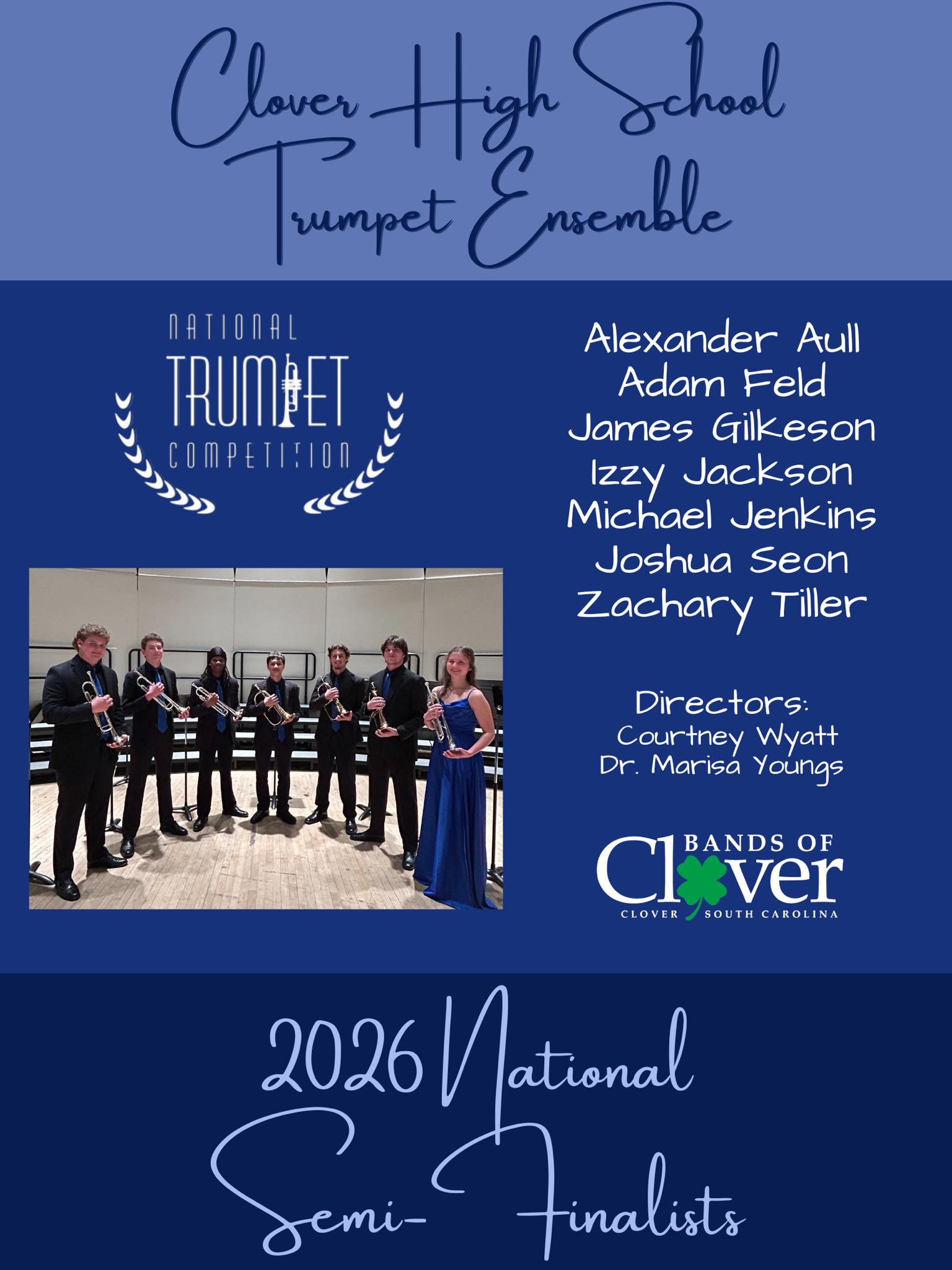

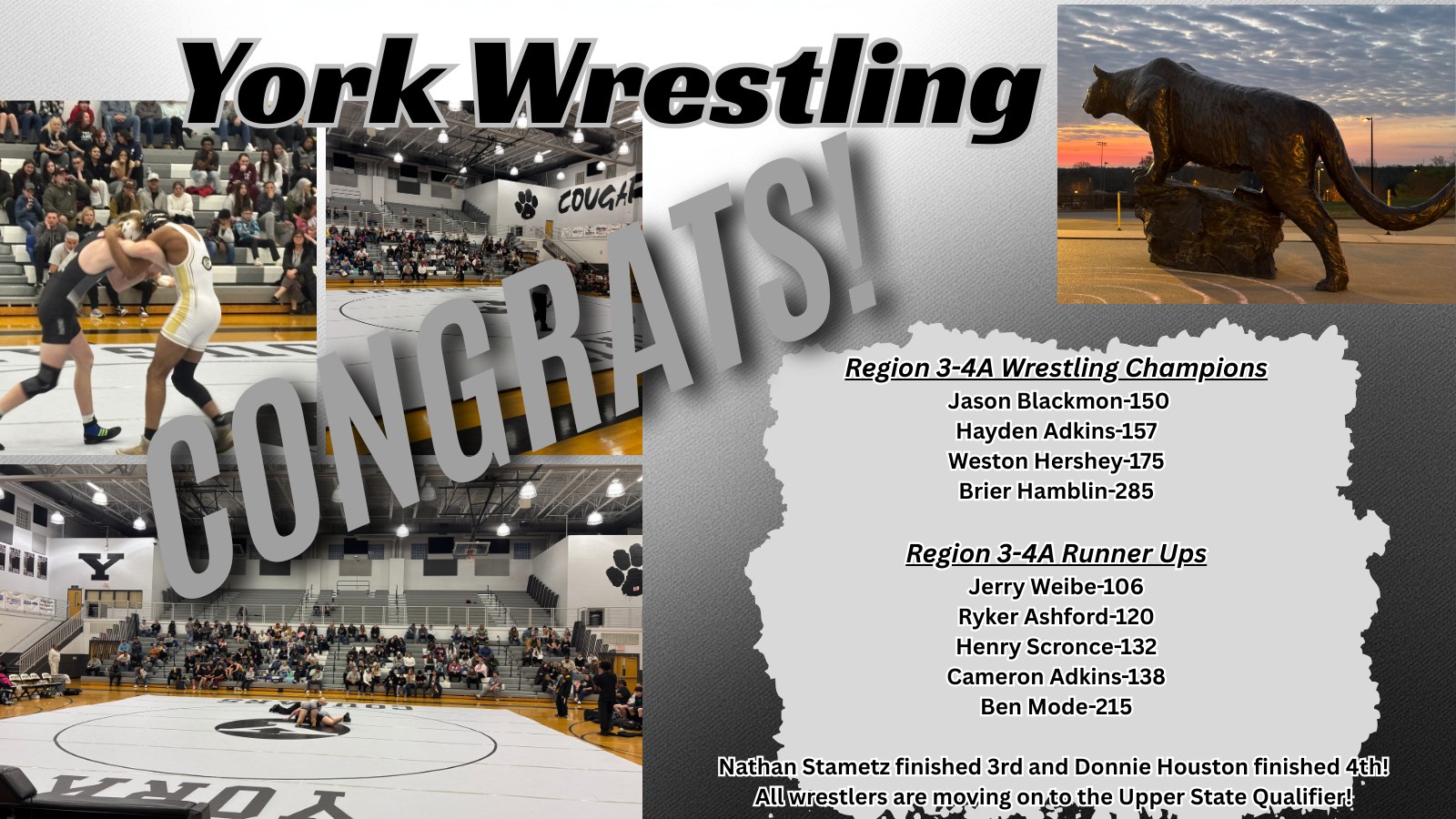

Special Recognitions

- Check presentation to the District from the Foundation for Fort Mill Schools – Mr. Scott Patterson and Mr. Greg Brobst. The Foundation for Fort Mill Schools is donating $57,400 to purchase a Starlab Dome to be used in conjunction with the district’s Meteorology, Astronomy and Geology courses. A Starlab dome, also known as a portable planetarium, is an inflatable, lightweight dome that is used to project images of the night sky onto its interior surface. It’s designed to be set up easily in various locations like classrooms, auditoriums, or gyms. These domes are typically used to teach science concepts in an immersive, interactive way.

Discussion of the 2025-2026 Budget

Mrs. Leanne Lordo shared information regarding the Proposed General Fund Budget for the upcoming Fiscal Year 2025-26.

State Data and Budget Information

- In January, Governor Henry McMaster and Superintendent Ellen Weaver presented a State Budget Plan for Education that included an increase to teacher pay of $3,000 to move the starting teacher pay from $47,000 to $50,000 state-wide. This would require an increase in the pot of Education Funding of $200 million.

- In March, the House Ways and Means and Full House passed a budget plan to increase teacher pay by only $1,500 to $48,500, and only increase education funding by $112 million.

- Last Wednesday Senate Finance Committee adopted its version of the FY26 Appropriations Act (State Budget)

- No discussion of any additional funding for State Aid to Classrooms

- K-12 closely aligns with House plan

- Largest commitment was $290 million in surplus funds to lower the State’s income tax rate from 6.8% to 6% to provide individuals with tax relief.

- Both House and Senate did collapse the teacher pay scale and eliminate the Bachelor’s + 18 hr. classification

- Senate Finance included an increase of $17 million for State Health Plan to eliminate the House requirement for increasing employee premiums. This is important because of the $1,500 increase in teacher pay, approx. $400 would go for health insurance.

- Senate Finance also increased funding $29.4 million for School SRO’s, approx. 177 new positions. House did not include funds for SRO’s.

- Still going back and forth on the Education Scholarship Trust Fund – Senate Finance decreased State Budget funding $25 million. House had funded $45 million from General Funds. Senate funded from Lottery.

- Full Senate will meet next week to discuss State budget plan.

- The Board of Economic Advisors (BEA) met on Thursday to provide an update on General Fund revenues. In the two months since adopting the revised estimates in February, the revenue excess has more than doubled, increasing by $283 million. While the General Fund revenue is $510.9 million ahead of expectations through March, the BEA recommended no change in the revenue forecast for FY25 and FY26.

While there has been in increase since the previous estimate was adopted, according to Frank Rainwater, it is too early to determine the impact of tariff changes on individuals and businesses; the possibility of slower economic growth/possibility of a recession; and the actual revenues will not be known until the 2023 and 2024 fillings (extended to May due to Hurricane Helene) are processed. Even though the BEA did not recommend increasing the projections, lawmakers still have about $1.9 billion in new (recurring and non-recurring) funds available for next year’s budget.

Budget Process:

We began our budget process in January with requesting the schools and departments to submit their needed requests after meeting with faculty, staff, and SIC’s. The senior leadership team met with all principals and department heads to discuss their requests in person. Generally, we meet in groups with elementary, middle, and high school principals. It is extremely beneficial to have those group discussions. I want to share that we feel their requests are well thought-out and truly needed items, not just “wish list”.

We continue to be disappointed with the new Education Funding Model. There has been no improvement in the funding distribution formula for next year in consideration of faster growing, lower poverty districts like ours. The projections sent out to date seem to be more focused on providing charter school funding and less equitable to all the k-12 public school districts.

The district is committed to presenting a budget which we feel will maintain our ability to continue our level of academic excellence and provide our students with highest level of instruction that our community has come to expect.

Budget Goals:

- Balanced Budget

- Focus on Recruiting and Retaining staff in all areas – highest priority to adjust all salary scales

- Maintain Reasonable Class Sizes

- Stay in Compliance with all regulations

Proposed Budget Summary of Revenues and Expenses:

- Recommending a total budget of $253,028,675

- Salaries/fringe continue to be 89.6% of budget with operational facility costs 5.7% = 95% of budget

State Aid to Classrooms Funding Model:

- Allocations increased $3,729,262 – will cover only about 45.8% of teacher pay increases

- Only 38.1% of budgeted revenue

Revenue Projections (58.5% local funds, 41.4% state funds, .10% federal):

Local Revenue:

- Local Taxes – Projection of $144,187,483 does include a 2% growth rate for tax collections and a millage increase of 21.2 mills.

- Millage Rate Limitation: CPI 2.95%, Population Growth 4.45% = 7.40% of 2024-25 millage yields max millage rate increase allowed of 21.2 mills.

- Using Value of a mill at $360,000 for new budget based on 2024-25 collections.

- Interest Income – LGIP Interest Rates have only decreased slightly since January and remain at 4.54% for the average monthly rate in March.

- Overall budgeted local revenue increase is $13,373,725.

State Revenue:

- New state funding model allocation increase only $3.7 million.

- We do expect bus driver allocation will increase for the mandated 2% bus driver salary increases after state receives final route information, but difficult to predict.

- Overall budgeted state revenue increase is $4,616,820.

Other Revenue and Totals:

- Budget plan still keeps a needed contingency transfer of $2,800,000 for opening Flint Hill Elementary School next year. This is an increase of $800,000 from the current year budget.

- Projected Student Enrollment of 18,618. Current ADM at 135 day is 18,188.

- County Wide millage has been consistent at 30 mills and is divided by the 4 York County school districts, with York receiving 1 mill off the top and the remaining 29 mills allocated based on the 135-day ADM %’s. We are now the largest in enrollment among the York County districts and have continued to receive a higher % over the past couple years.

- Reminder – Tax Year 2025 in October will be a property reassessment year by York County. In accordance with State Law, tax millage will be rolled back to equal tax collections from the previous year before any new millage is added back.

Proposed New General Fund Expenditures:

- Normally broken down by Category 1, 2, 3, and 4 Priorities – The district will only have new revenue to fund Priority 1 items

- Of the total budget requested increase of $18.8 million:

- Category 1 Personnel related to salary/fringe $17,177,815

- Category 1 are items prioritized and mandated such as teacher and staff salary increase, shifted positions, and committed items such as new teachers, contract inflationary increase, and “cash out the door” for facilities operations = 21.2 mills needed to make up difference between new state funding and other local.

- The State Minimum Teacher Salary Scale will increase from $47,000 to $48,500. Our teacher scale is already starting at $50,000, which would require no increase. However, the administration recommends increasing our starting teacher pay to $52,500 based on our goal of teacher recruitment and retention.

- Teacher pay would increase 5%, Administration is recommending a 4% Cost of Living Increase for all other employee group pay scales.

Contingency Reserve Update

- Beginning of Year $4,581,581

- Paid for Impact Fee Legal Services and Annual York County Fee

- The district will transfer the budgeted 2024-25 $2,000,000 to General Fund.

Superintendent Search Committee Update

Board member Lipi Pratt provided an update on the search for the Fort Mill School District Superintendent which included the timeline below:

- Application Deadline: April 28, 2025

- The Board chooses and arranges interviews with candidates -May

- The Board conducts second interviews, chooses finalists, conducts negotiations and

- announces the finalist

- The Board appoints the new superintendent and negotiates the contract –May

- The Board presents the new superintendent to the community –May

- The superintendent starts on or before July 2025

More information regarding the feedback provided and the search process is available on the district website here.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.