The Social Security Administration (SSA) has implemented its 2026 updates, bringing significant changes to the financial thresholds for Social Security Disability Insurance (SSDI). While the medical criteria for disability remain the same, the administrative benchmarks—designed to keep pace with the national average wage and inflation—have shifted.

If you are currently receiving benefits or planning to apply, understanding these new figures is essential for maintaining eligibility and managing your monthly budget.

Key Financial Shifts for 2026

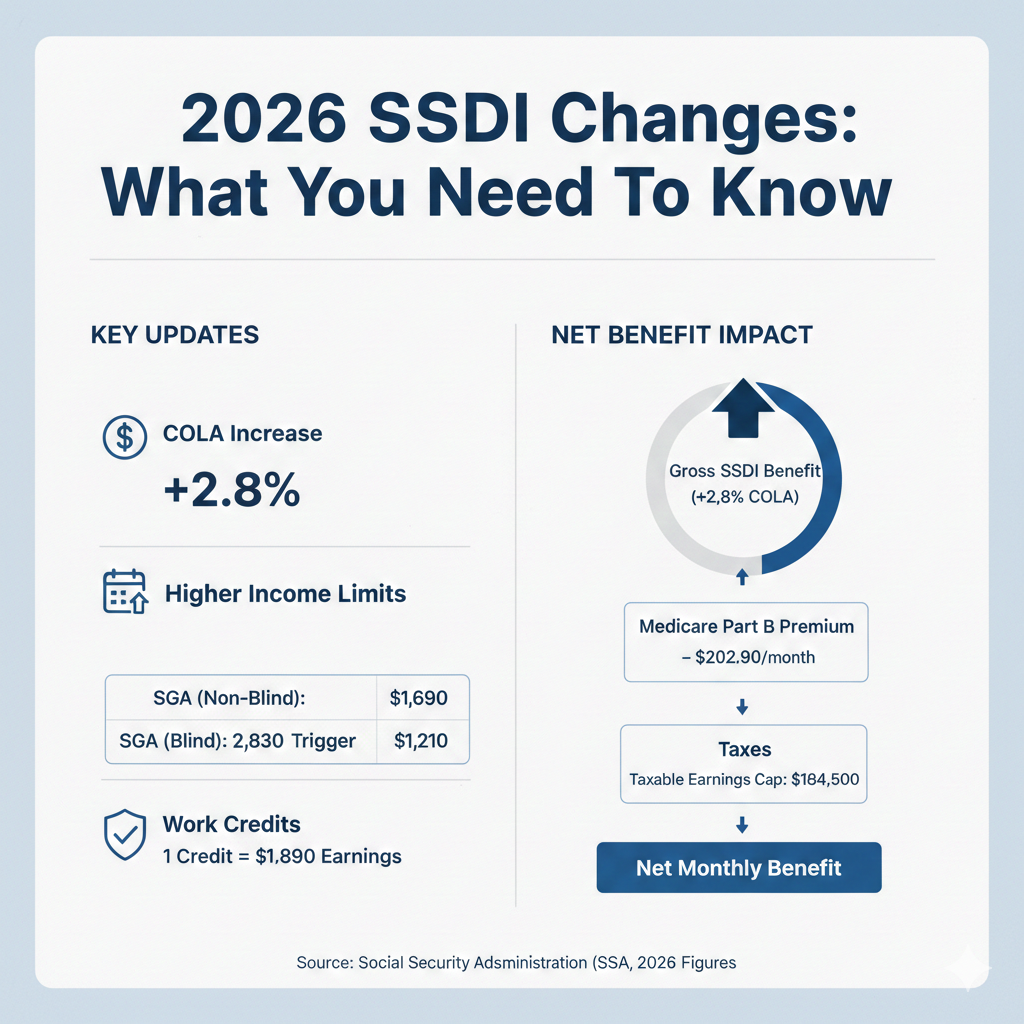

The most immediate change for many is the 2.8% Cost-of-Living Adjustment (COLA). Starting in January 2026, this increase was applied to all Social Security benefits to help offset rising costs for housing and healthcare.

| Category | 2025 Amount | 2026 Amount | Change |

| SGA Limit (Non-Blind) | $1,620 | $1,690 | +$70 |

| SGA Limit (Blind) | $2,700 | $2,830 | +$130 |

| Trial Work Period (TWP) Trigger | $1,160 | $1,210 | +$50 |

| Work Credit Value (1 Credit) | $1,810 | $1,890 | +$80 |

| Medicare Part B Premium | $185.00 | $202.90 | +$17.90 |

Understanding the Income Limits

1. Substantial Gainful Activity (SGA)

The SGA is the monthly gross income ceiling. If you consistently earn above this, the SSA may determine you are no longer “disabled” by their legal definition. For 2026, the limit is $1,690 for most, but those with statutory blindness have a higher threshold of $2,830.

Note: SGA is calculated based on gross income (before taxes), not your take-home pay.

2. The Trial Work Period (TWP)

The TWP allows you to test your ability to work without losing benefits. In 2026, any month where you earn more than $1,210 counts as one of your nine “trial” months. Once you use all nine months within a five-year window, the stricter SGA limits apply.

3. Earning Your Way to Eligibility

To qualify for SSDI, you must have enough “work credits.” In 2026, you earn one credit for every $1,890 in taxable income, up to a maximum of four credits per year.

The “Net” Reality: Medicare and Taxes

While the 2.8% COLA increase boosts your gross benefit, the Medicare Part B premium has also risen to $202.90 per month. Since this is deducted directly from most SSDI checks, your “net” increase may feel smaller than expected.

Additionally, the maximum taxable earnings cap has risen to $184,500. For high earners, this means a larger portion of income is subject to Social Security taxes, which ultimately funds the system and can lead to a higher maximum benefit (reaching up to $5,181 for those retiring at the maximum level in 2026).

Staying Compliant

The SSA emphasizes that these adjustments are “essential to maintaining the economic value of benefits.” However, even a small mistake—like earning a few dollars over the SGA limit during a five-week month—can trigger a benefits review.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.