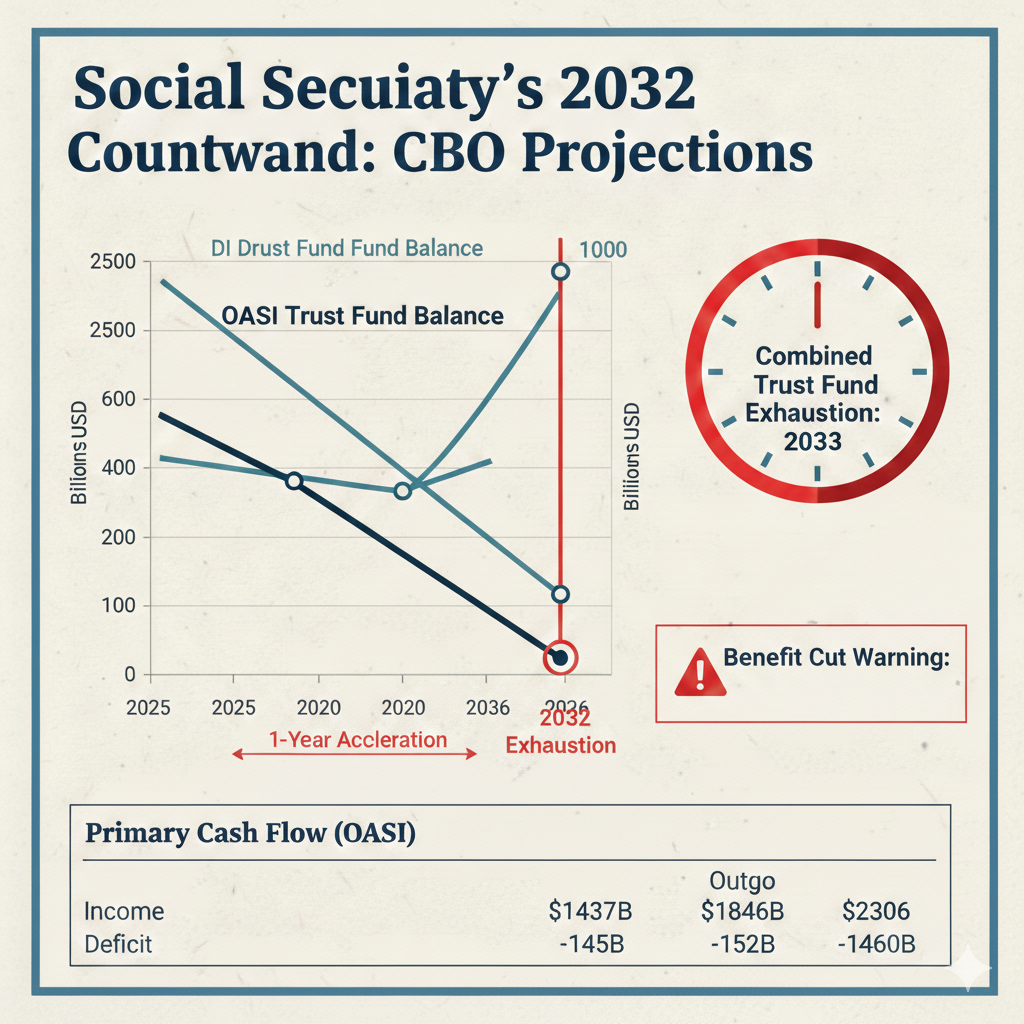

A new report from the Congressional Budget Office (CBO) indicates that Social Security’s financial trajectory is tightening, with key trust funds projected to reach exhaustion one year sooner than previously estimated by the Social Security and Medicare Boards of Trustees. While Social Security is part of the unified federal budget, its benefits are paid from specific trust funds primarily financed by payroll taxes, interest earnings, and income taxes on benefits.

Key Projections for Trust Fund Exhaustion

The CBO’s February 2026 baseline highlights a diverging path for the two primary funds that support the program:

-

Old-Age and Survivors Insurance (OASI): This fund, which pays benefits to retirees and their survivors, is projected to be exhausted in 2032.

-

Disability Insurance (DI): In contrast, the DI trust fund shows a more stable outlook, with the end-of-year balance projected to grow from $215 billion in 2025 to $885 billion by 2036.

-

Combined Outlook: Although the two funds are legally separate, the CBO notes that if they were combined, the total balance would be exhausted in 2033.

The Reality of “Exhaustion”

Under current law, the Social Security Administration (SSA) is prohibited from paying benefits that exceed the available balances in a trust fund. It also lacks the legal authority to borrow money for a trust fund or transfer funds between them.

However, for the purpose of budget baseline construction, the CBO is required to assume that scheduled payments will continue in full even after a fund is exhausted. This creates a projected “shortfall” that illustrates the gap between scheduled benefits and available revenue:

| Year | Cumulative Shortfall (Not Including Interest) | Cumulative Shortfall (Including Negative Interest) |

| 2032 | -$142 Billion | -$142 Billion |

| 2034 | -$1,322 Billion | -$1,391 Billion |

| 2036 | -$2,665 Billion | -$2,916 Billion |

Note: Shortfall data specifically for the OASI Trust Fund.

Financial Trends and Cash Flow

The CBO report details a persistent “Primary Cash Flow” deficit for the OASI fund, meaning that even when excluding interest income, the outgo exceeds the income.

-

Rising Costs: Total outgo from the trust funds is expected to climb from $1.58 trillion in 2025 to over $2.75 trillion by 2036.

-

Revenue Streams: While payroll tax revenue is projected to rise steadily—reaching $1.96 trillion by 2036—it is not keeping pace with the growth in benefits.

-

Interest Decline: As the OASI balance is drawn down, the interest earned on that balance is projected to fall from $70 billion in 2025 to $20 billion by 2032, before the fund hits exhaustion.

Ultimately, the CBO notes that future legislation will be required to determine if these shortfalls will be funded and how the trust funds will handle potential financing costs moving forward.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.