A proposal to overhaul and eventually eliminate South Carolina’s state income tax moved forward this week, clearing its first hurdle in a Senate subcommittee. The legislation, which previously passed the House of Representatives, seeks to restructure the state’s tax code into a simpler system with a built-in mechanism to reduce rates to zero over the coming years.

State lawmakers describe the bill as a direct effort to return money to South Carolinians by capitalizing on the state’s consistent economic growth.

The New Two-Tier Model

The proposal would replace South Carolina’s current three-bracket system—which features rates of 0%, 3%, and 6%—with a more streamlined two-tier structure. Under the new plan, the tax rates would be set as follows:

-

1.99% for individuals earning less than $30,000.

-

5.39% for individuals earning more than $30,000.

In addition to changing the rates, the bill shifts the basis of state taxes. Currently, South Carolina is one of only five states that uses federal taxable income as its starting point. This legislation would instead utilize Adjusted Gross Income (AGI). To balance this shift, the bill eliminates federal standardized and itemized deductions, replacing them with a new South Carolina Income Adjusted Deduction specifically designed to protect lower-income taxpayers.

The Path to Zero: Automatic Triggers

A primary feature of the legislation is a long-term plan for the total elimination of the state income tax. The bill establishes an automatic “trigger” tied to the state’s financial performance. Specifically, any time the state’s income tax revenue grows by 5% or more, the tax rates would automatically drop.

Lawmakers believe this incremental approach allows the state to respond to a growing economy by gradually phasing out the tax without causing sudden shocks to the state budget. Governor Henry McMaster has indicated his support for this trajectory, having recently suggested a preliminary reduction of the top rate from 6% to 5.99% in his own executive budget.

Who Is Affected?

Projections included in the bill provide a breakdown of how the 2026 tax year would look for South Carolinians if the measure becomes law. While many residents would see a lighter tax burden, the removal of certain federal deductions means some taxpayers could see their bills rise.

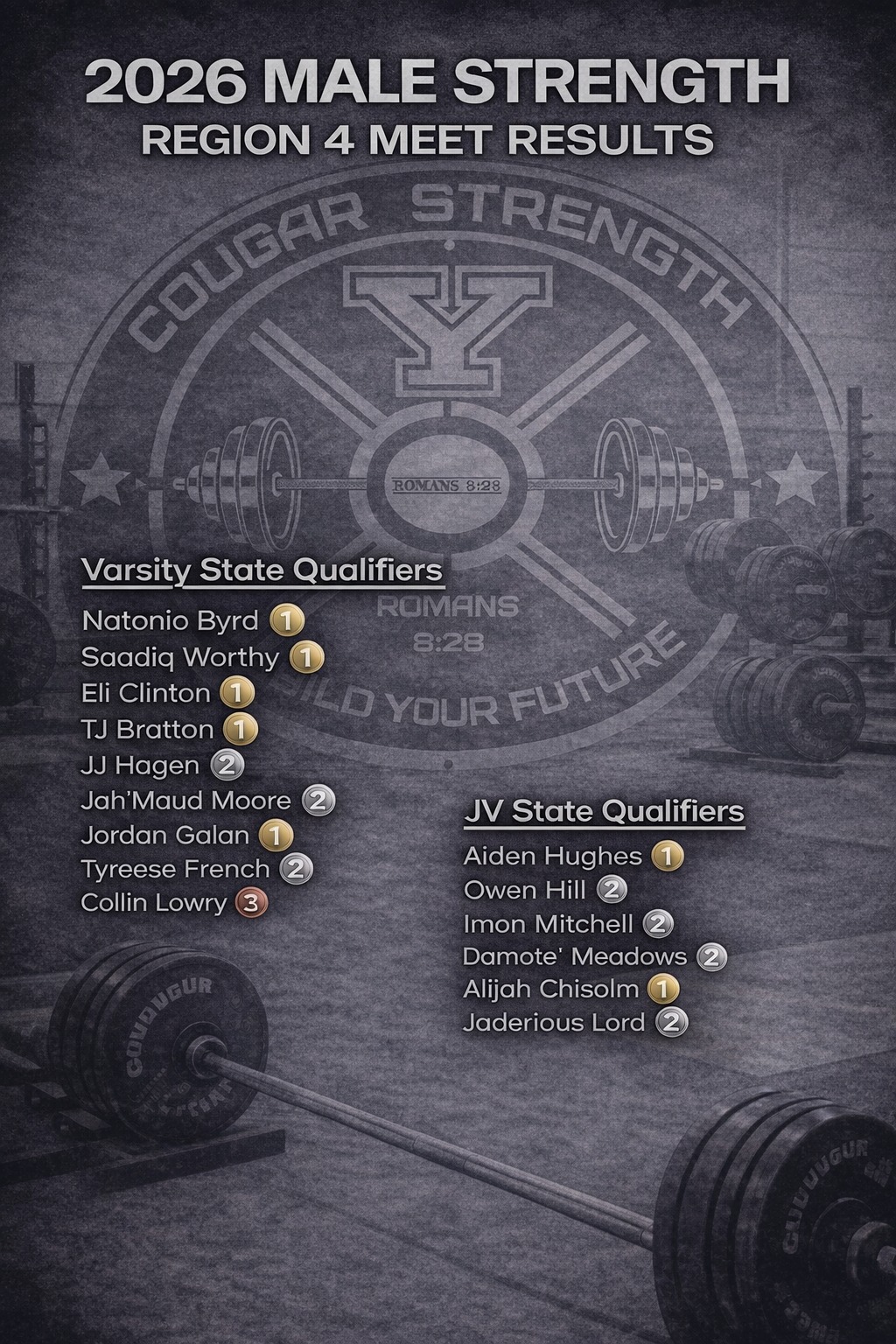

Projected Impact on 2026 Tax Bills:

| Impact on Taxpayer | Percentage of Taxpayers |

| Decrease in Tax Bill | 38.7% |

| No Change in Tax Bill | 34.6% |

| Increase in Tax Bill | 26.7% |

The bill also seeks to close an existing loophole that currently benefits high-wealth residents. Proponents of the bill noted that approximately 3,000 residents earning over $1 million annually currently pay no state income tax. The new structure is designed to ensure these individuals contribute to the state’s revenue.

Next Steps

The legislation now moves to the full Senate Finance Committee for a scheduled vote on Tuesday. If the committee grants its approval, the bill will head to the Senate floor for a final round of debate. If passed and signed into law, the new tax structure and its initial rates would take effect starting with the 2026 tax year.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.