YORK, S.C. (Sept. 5, 2025) — A York County woman has been arrested and charged with multiple tax-related offenses following an investigation by the South Carolina Department of Revenue (SCDOR).

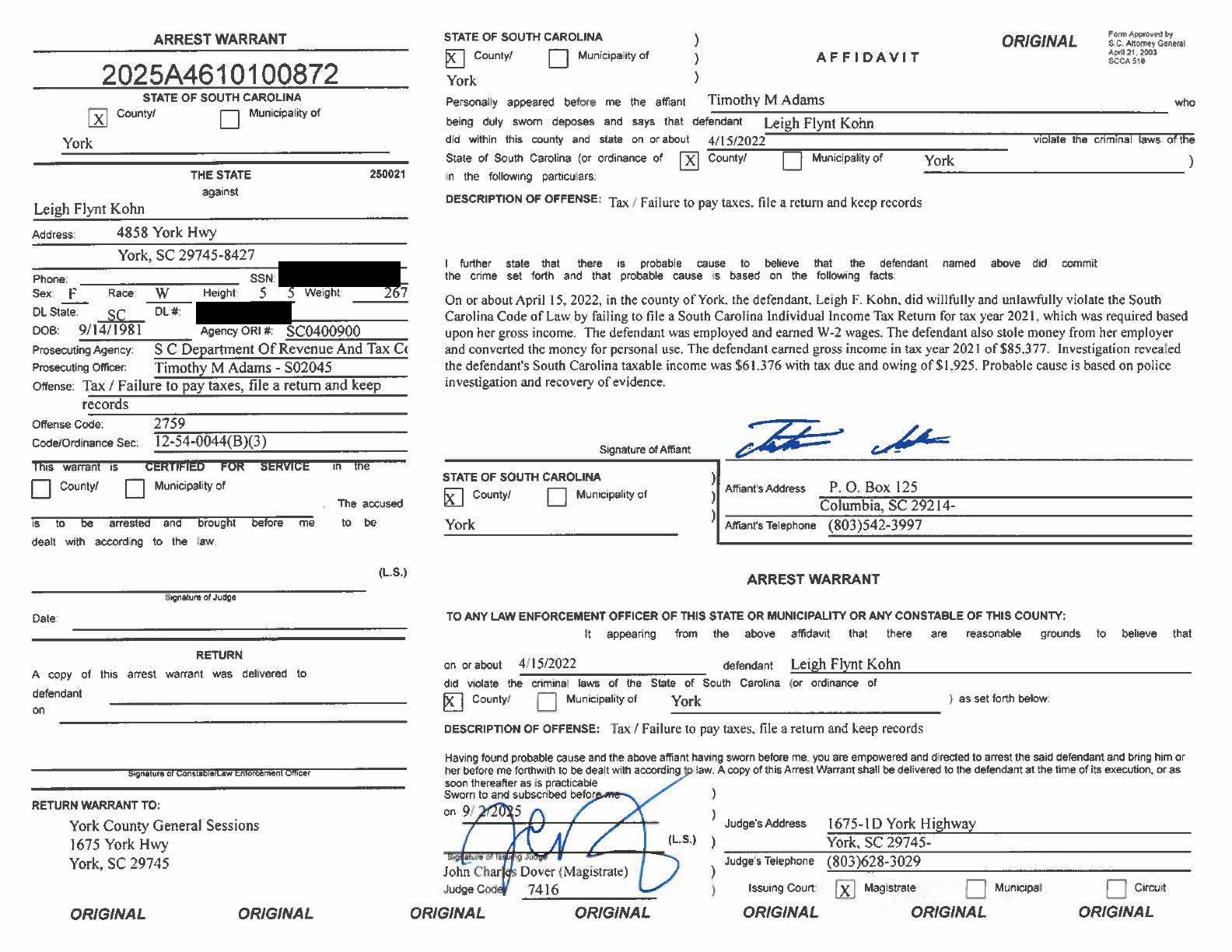

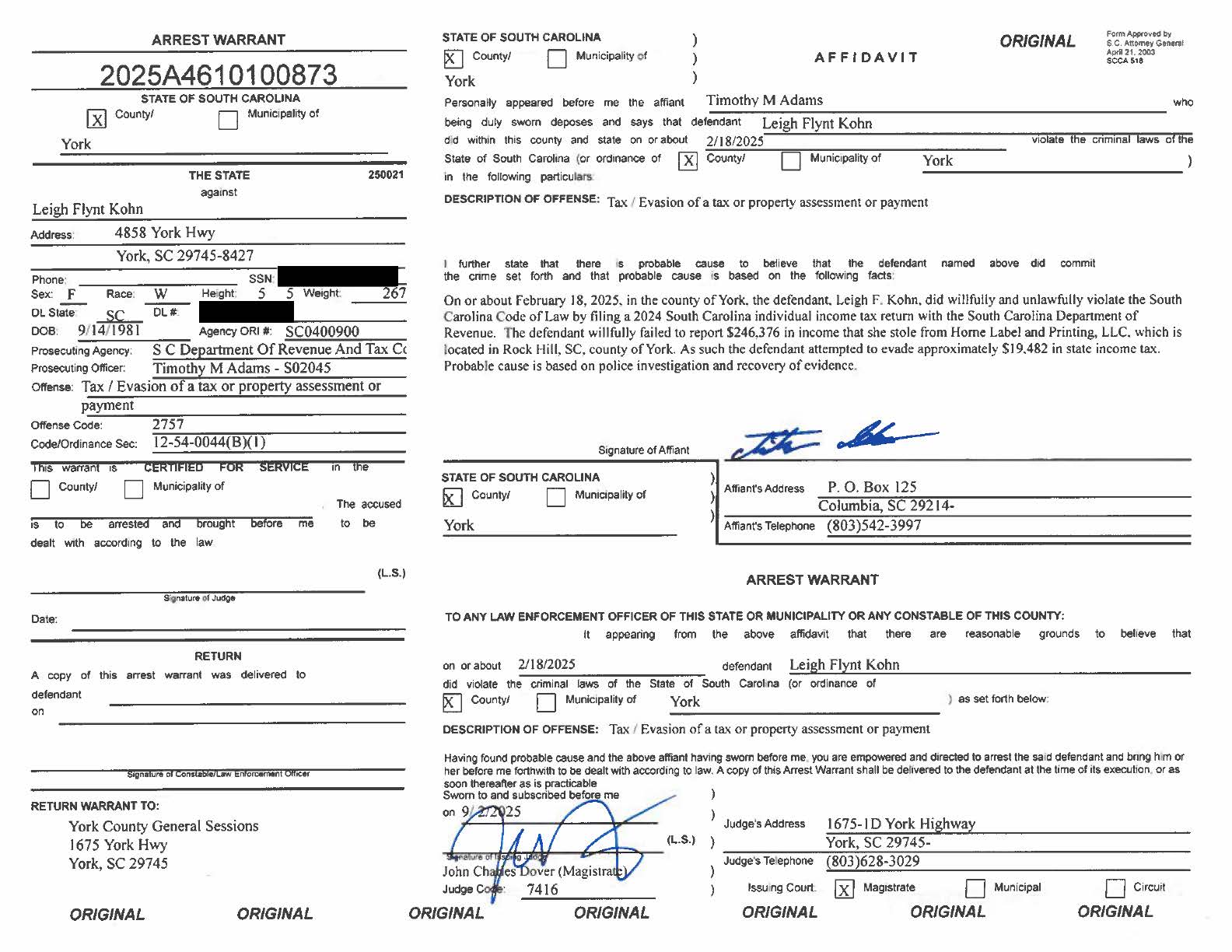

Leigh Flynt Kohn, 43, of York, was taken into custody on Friday and charged with two counts of tax evasion and one count of failing to file a state Individual Income Tax return.

According to arrest warrants, Kohn is accused of failing to report at least $281,000 in income on her 2023 and 2024 South Carolina tax returns. She is also alleged to have failed to file a required tax return for the 2021 tax year.

Investigators say the unreported income was tied to funds Kohn allegedly stole from her employer. Based on the charges, she owes $23,542 in unpaid state income taxes.

If convicted, Kohn faces up to five years in prison and/or a fine of up to $10,000 for each count of tax evasion. The charge for failure to file carries a maximum sentence of one year in prison and/or a $10,000 fine.

Kohn is currently being held at the York County Detention Center pending a bond hearing.

The SCDOR encourages residents to report suspected tax fraud or evasion by submitting a Tax Violation Complaint Form (CID-27) to [email protected] or by mail to the South Carolina Department of Revenue, Attn: Fraud Advisor, 2070 Northbrook Blvd, Suite B7, North Charleston, SC 29406.

Sources:

- South Carolina Department of Revenue – News Release, Sept. 5, 2025

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.