This past week was a rough one for anyone with an investment portfolio. The massive drops in the market may be causing anxiety, mental anguish and perhaps anger across this great country of ours. I won’t wade into the political waters of why it’s happening or what my thoughts are. As I’m not an economist, no one would care anyway. What I will do is to hammer home a point that I’ve been harping on within this column for the better part of two years.

The American dream is not dead, it’s just different than what you’ve been sold. Watch any reality show and you see people living with reckless abandon. They’re spending like there’s no tomorrow, eating the best food(s) and driving luxury cars. Most reality shows are anything but reality.

The reality of most Americans is very different. A reliance on credit cards and a lack of understanding when it comes to financing locks people into long term debt with no easy way out. This is the way you’ve been told to reach for the American dream and keep up with the false idols perpetrated on TV and social media.

I’m going to suggest a different way. Follow these 3 simple steps to get to where you want financially and achieve true happiness:

Boost Your Savings

If you’re new to saving money, start small. Take $25 from each paycheck and place it into a savings account. You may think this is insignificant, but it’s more the act of saving anything at this point rather than the dollar amount. Once you become comfortable with this amount and it’s a part of your routine, you can increase by $10 each paycheck until you’ve reached the threshold of what you can afford to save depending on your budget.

Pay Cash, Avoid Credit

The American dream is freedom. Freedom from debt and ownership of the things you need for you and your family to not only survive, but thrive. Having large outstanding loans that you’re paying on each month will hinder your ability to attain the freedom and happiness you desire. It’s hard to put your wallet away and avoid buying something you really want. It’s even harder to be paying on those items for months or years to come due to high interest rates. Living by this principle is simple: if you can’t afford to buy it outright, you can’t afford it.

Ignore the Noise

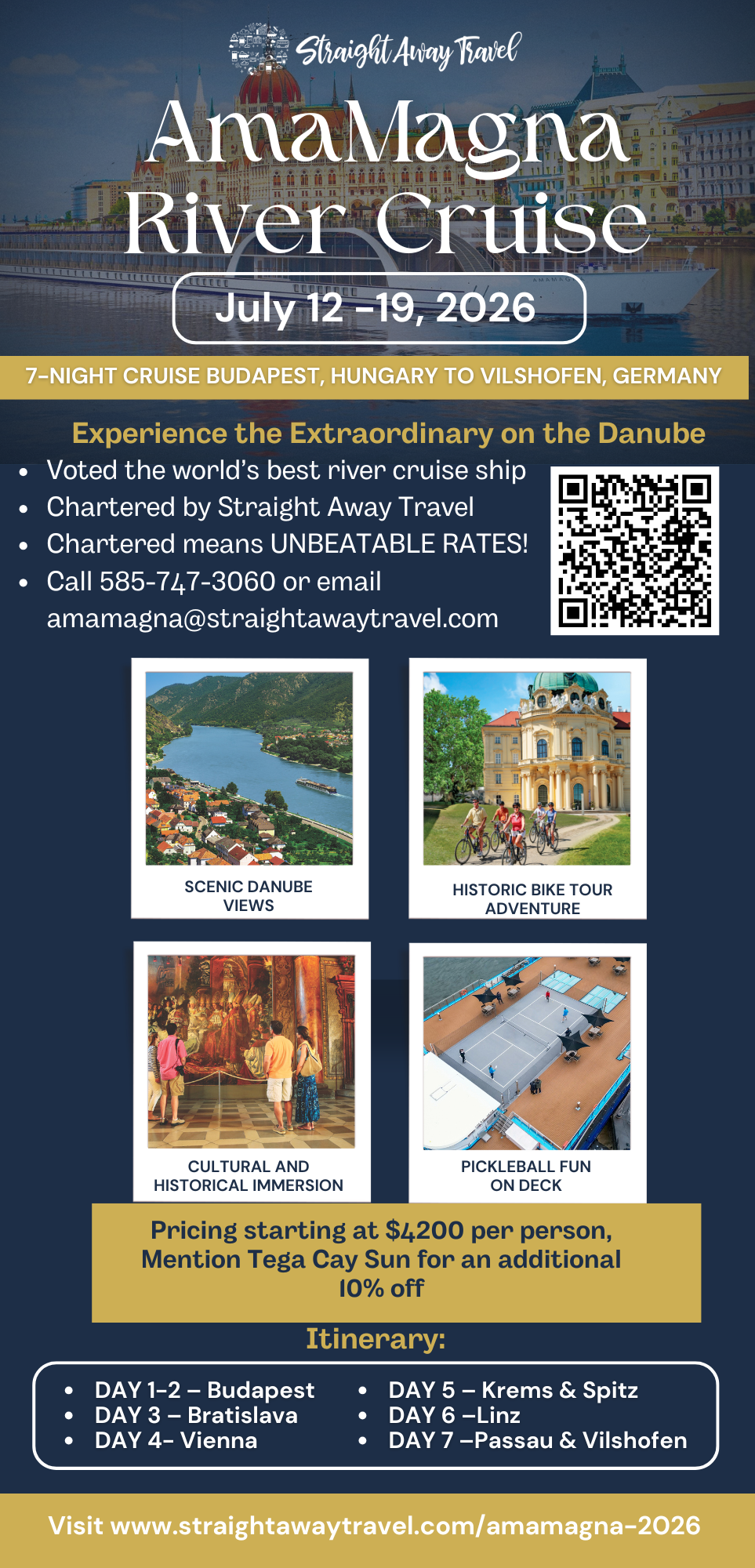

Marketers are constantly bombarding us with couples on a river cruise, drinking champagne, living the good life. That’s great, if you can afford it. For the rest of us, we’re living in the real world. We have bills to pay, mouths to feed and colleges to pay for. Staying true to yourself, what’s best for your family and your long term financial goals is easy once you see the world for what it is. You’re being sold a bag of goods. If you don’t like what’s in the bag, hand it back over and fill it with what you want instead. Personally, I like filling mine with cash.

In the end, having cash on hand and owning the things you need to survive offers a sense of pride and security no amount of money would be able to buy. Ownership is also a hedge against the ups and downs of the stock market. You will stress less about losing thousands of dollars in a day because you have a roof over your head, a car you can drive and food in your pantry.

The market will go up and it will go down causing sleepless nights and a feeling of helplessness if you’re not well positioned to weather the storm.

Hop in a boat of tranquility by owning what you need and sailing along a river of cash in your pockets and shredded credit cards in your wake.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.