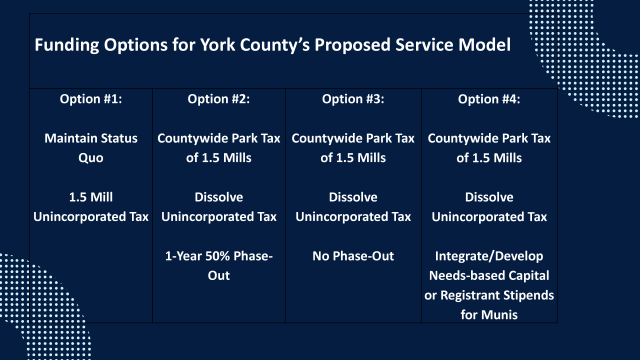

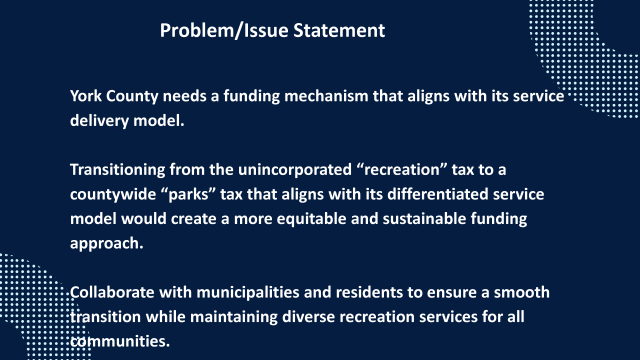

In a contentious 2-1 vote on March 27, the York County Health & Environmental Protection (HEP) Committee recommended a significant shift in how parks and recreation are funded across the county. The committee endorsed Option #4—a proposal to eliminate the long-standing 1.5 mill recreation tax on unincorporated residents and replace it with a new countywide parks tax of 1.5 mills applied to all York County residents.

A 20-Year Partnership in Jeopardy

For over two decades, unincorporated York County residents have paid a 1.5 mill recreation tax that allowed them to participate in municipal parks and recreation programs—especially youth sports—at the same rate as municipal residents. This arrangement provided fairness, as towns like Rock Hill, Fort Mill, Clover, York, and Tega Cay fund their parks and leagues through municipal taxes. Without this structure, unincorporated residents would benefit from municipal resources without helping to fund them.

Now, the county’s proposed change eliminates that recreation tax for unincorporated areas but still expects those residents to pay the same registration fees to participate in municipal leagues—despite not contributing to municipal park funding.

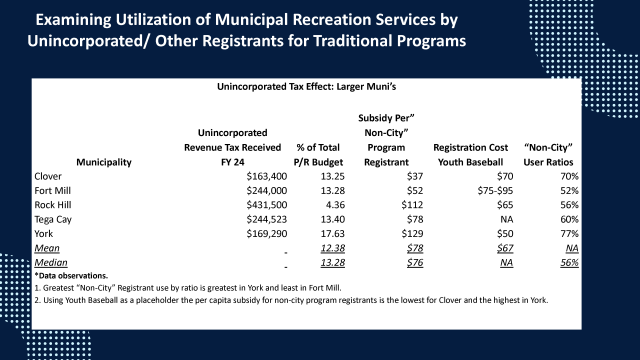

The Numbers Don’t Add Up: Majority Use, Minority Pay

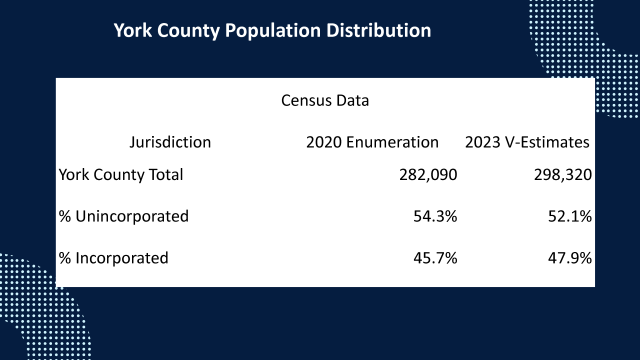

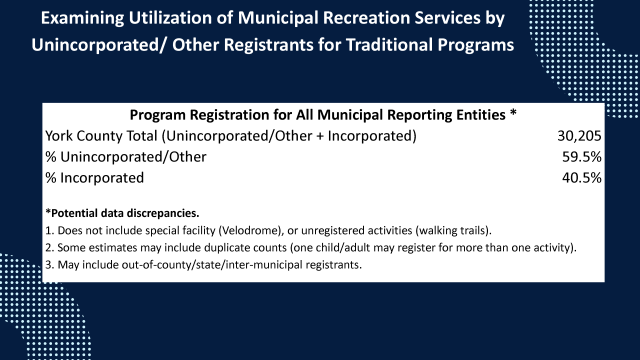

According to county data, 59.5% of all sports program registrations come from unincorporated residents, meaning the majority of participants in municipal sports programs do not live in the municipalities that fund them. Yet under the proposed tax change, the 48% of York County residents who live in towns and cities will be expected to fund those programs twice—once through their municipal taxes and again through the new countywide parks tax.

Meanwhile, the 52% of county residents who live in unincorporated areas would no longer contribute anything toward the municipal programs they heavily use. If this proposal is approved, nearly 60% of the county—who live outside city limits—may lose access to sports programming altogether or be forced to pay significantly higher non-resident fees.

Residents and municipal officials alike are questioning the fairness of asking a minority of the population to subsidize the majority of participants.

Municipalities May Be Forced to Raise Fees or Exclude Participants

Critics argue the proposal would unfairly shift the burden of funding youth sports leagues onto municipal taxpayers. “This is a tax increase on city and town residents disguised as equity,” one opponent noted. “Unincorporated residents would no longer pay into the municipal systems they use but still expect the same access.”

With municipal residents potentially paying both city and county park taxes, officials warn they may have no choice but to raise participation fees for non-residents or exclude them altogether from leagues and programs. The likely result: kids from unincorporated areas may be priced out or left out entirely.

Who Voted and Why It Matters

HEP Committee members Debbie Cloninger (District 7 – Fort Mill area) and Andy Litten (District 2 – Lake Wylie area) voted in favor of Option #4. Watts Huckabee (District 9 – Rock Hill) cast the lone dissenting vote, citing concerns about fairness and the added burden on incorporated residents.

Cloninger and Litten’s support for the countywide tax increase has drawn criticism from many constituents, particularly in Fort Mill and Rock Hill, where parks are heavily used by both municipal and unincorporated residents. Many believe the current system—where everyone pays something—has worked well and shouldn’t be dismantled.

What’s at Stake

If approved by the full County Council, this plan would increase taxes on municipal residents while giving unincorporated residents a free pass to use local sports programs without helping to fund them. With no county-operated youth leagues and no county parks north of the Catawba River, many are questioning what, exactly, their new tax would be funding.

Opponents warn that this move could severely disrupt youth sports in York County, leaving families with higher fees—or no access at all.

What Can Residents Do?

York County residents are encouraged to contact their County Council members to answer any questions or concerns:

Christi Cox. Council Chairwoman

PO Box 66, York, South Carolina 29745

Phone: 803-630-9526

Email: [email protected]

Tom Audette, Vice-Chairman

PO Box 66, York, South Carolina 29745

Phone: 704-408-6155

Email: [email protected]

Andy Litten, District 2

PO Box 66, York, South Carolina 29745

Phone: 839-270-9383

Email: [email protected]

Tommy Adkins, District 3

P.O. Box 66, York, South Carolina 29745

Phone: 803-628-8328

Email: [email protected]

William “Bump” Roddey, District 4

P.O. Box 66, York, SC 29745

Phone: 803-984-8033 Email: [email protected]

Watts Huckabee, District 6

P.O. Box 66, York, SC 29745

Phone: 803-965-8407

Email: [email protected]

Debi Cloninger, District 7

PO Box 66, York, SC 29745

Phone: 803-965-8393

Email: [email protected]

This is a developing story. Additional updates will be provided as they become available.

Sign up for our Sunday Spectator. Delivered to your inbox every Sunday, with all the news from the week.